Jazz Cash loan (2025) – Complete Step-by-Step Guide

How to Take a Loan from Jazz Cash (2025). – Complete Step-by-Step Guide how to Take a Loan from Jazz Cash (2025) and Complete Step-by-Step Guide? Learn how to take a loan from this app in 2025 with this step-by-step guide, including eligibility, and repayment methods. With this app Loan feature and you can borrow huge amounts of money instantly without visiting any bank or submitting heavy documents.

What is Jazz Cash Loan?

Jazz Cash one of Pakistan’s leading mobile wallets, offers (small Loans) too (huge loans) to eligible users through its app. And the loan can be used for emergency needs, bill payments, mobile top-ups, or anything else.

Who Can Take a Loan from Jazz Cash? (Eligibility Criteria)

To qualify for an Jazz Cash loan, you must:

• Have an active account.

• Be a Pakistani citizen with a valid CNIC.

• Be aged 18 or older.

• Regularly use the Jazz Cash app for transactions.

• Have a good transaction history.

Documents Required

Doesn’t require physical documents. And you just only need:

• Need Valid CNIC number

• Registered mobile number (on your CNIC)

• An active wallet with daily transactions

• An old Jazz Cash wallet

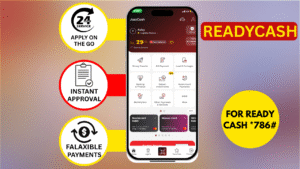

📲 How to Apply

Via App:

1. Log in to your App.

2. Navigate to the “Loan” section on the home screen.

3. Select “Apply for Ready cash”.

4. Choose your desired loan amount.

5. Accept the terms and conditions.

6. Enter your MPIN to confirm the request.

Repay loan via App

For Ready Cash:

1.Open the app in your mobile.

2. login to your app.

2.Tap on repay Loans top right on the home screen.

3.Select the amount (1000) (2000) (3000) .

5.Confirm the amount and enter your MPIN.

Tips for Easy Approval

• Use regularly for bill payments and transfers.

• Keep your wallet balance active.

• Don’t miss any repayments.

Enhancing Loan Eligibility

To improve your chances of qualifying for higher loan amounts:

•Maintain a Healthy Wallet Balance: Regularly keep funds in your wallet.

•Frequent Transactions: Use this app for various transactions like bill payments, mobile loads, and money transfers.

•Timely Repayments: Ensure that any previous loans are repaid on time to build a positive credit history.

Conclusion

Taking a loan from this app is quick, secure, and convenient — perfect for emergency cash needs. If you meet the basic eligibility and maintain a good history with the app, you can access instant loans with just a few taps. Download the app today and manage your financial needs more smartly.